As the insurance marketplace becomes increasingly fragmented, how can insurance brokers keep their products and services relevant to all generations?

There is little doubt that insurance is a trust-based industry, but with an ageing population of clients at one end of the spectrum and a millennial generation at the other, brokers need effective ways of engaging with a splintering customer base.

How are you developing relevant and engaging sales marketing to promote your commercial and personal policies?

Insurance brokering is built upon trust and expertise, and customers are now actively searching for companies that can educate them on what they need. After all, if you’re not in insurance, you need a broker with a strong understanding of all the multi-facets of risks involved.

How are you enhancing your customer experience to increase your revenue right now?

The margins between customer retention and loss become finer every year. The challenge for brokers now is to develop a customer-centric culture that keeps pace with exacting customer expectations.

We’re supporting UK brokers to generate more revenue in 2020, find out more below.

“BriefYourMarket.com has delivered an effective communication tool for engagement with our existing clients, which has resulted in additional business being generated.”

– FOCUS Oxford Risk Management Ltd

Each month, we prepare a marketing plan just for insurance brokers.

These inspirational campaigns are designed to increase your brand awareness, generate you more business and influence consumer purchasing decisions in 2020.

To help brokers solidify their reputation as trustworthy and reliable this February, we have put together a Valentine’s content marketing strategy, focusing on encouraging clients to protect the things – and people – they love most.

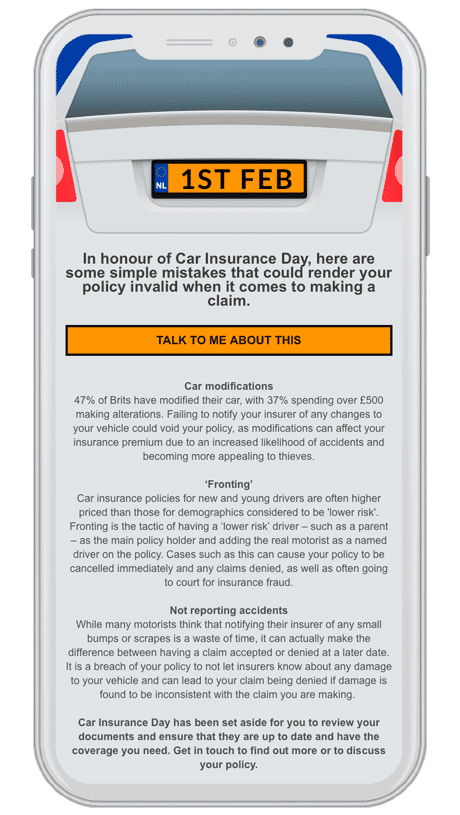

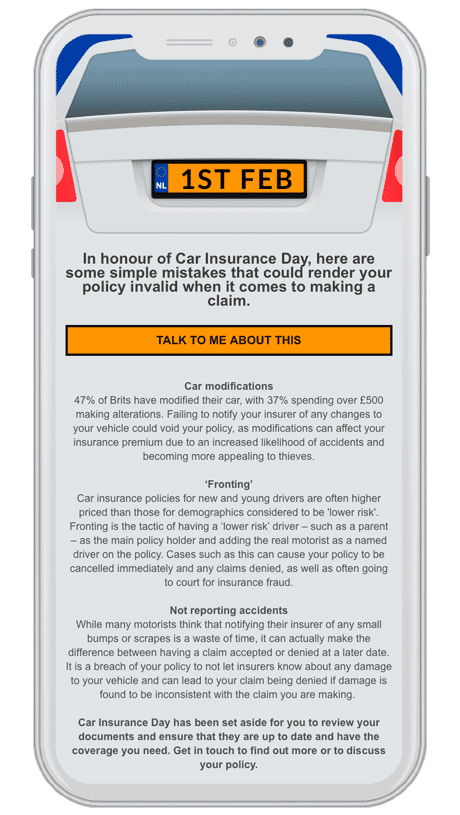

Car Insurance Day

| Falling on the 1st of February, Car Insurance Day provides you with a great opportunity to remind your clients about the importance of having adequate and accurate vehicle cover – whether it’s for personal or commercial purposes.

This campaign is a great way to use topical events and calendar dates to promote your services, and highlights the simple mistakes often made by drivers that could ultimately invalidate their car insurance. |

|

Valentine's Day

| In the run up to the day itself, promote a limited or exclusive Valentine’s offer or policy discount. Setting time limits creates a greater sense of urgency, leading to higher “purchase intentions”.

For maximum effect, we would recommend targeting your hottest prospects using your recent open and click-through reports to identify those ready to commit. With a non-promotional angle, this is a great engagement email to reach out to contacts in your database, targeting past clients or those with policies that are due to lapse with a specific offer to win back their business. |

|

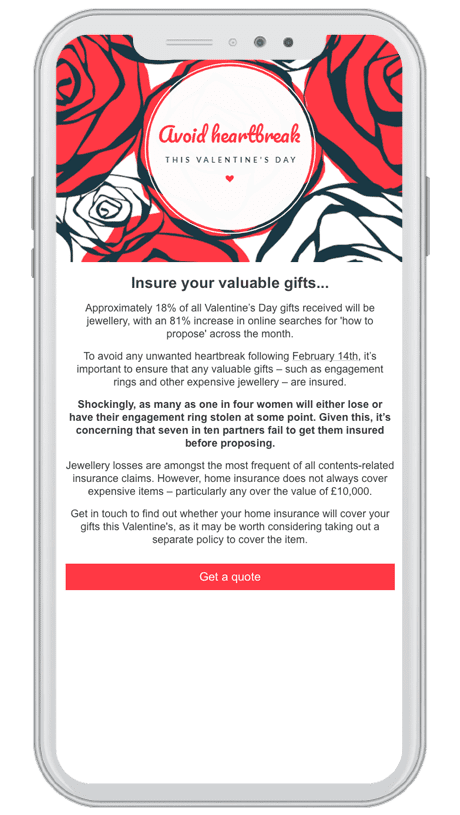

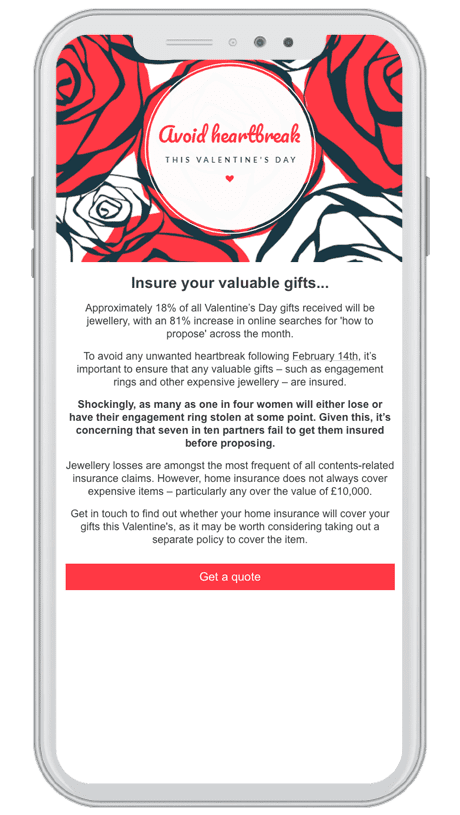

Avoid heartbreak

| High-value jewellery is one of the most commonly gifted items over Valentine’s Day, yet one that’s often overlooked when it comes to insurance – with seven in ten partners forgetting to organise engagement ring insurance before popping the question.

With online searches for “how to propose” surging 82% over February, and more than one million people likely to get engaged on the 14th, the chances are that many of those engagement rings will go uninsured until the buzz has settled down. This campaign reminds your clients to show caution with any high-value jewellery that they may give or receive. |

|

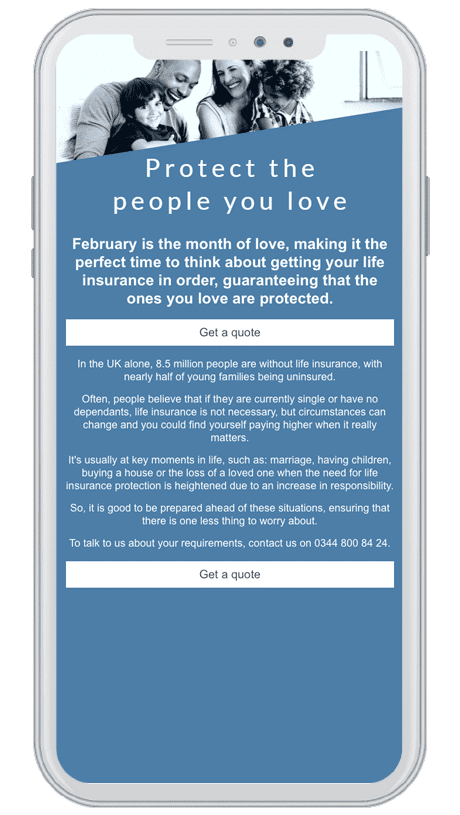

Life insurance

| Now that your customers are back on track after Christmas, many will be planning big changes for 2020. Whether it’s a new job, a new home, or a new addition to the family, make sure they’ve considered what this means for their policies.

In a month all about giving, this campaign is geared around your life insurance policies. Many UK adults put off obtaining cover, prioritising other purchases that they think are of more immediate importance. This email challenges the excuse of “I can put off life insurance for another year” and considers the benefits of organising it sooner rather than later. |

|

Car Insurance Day

Falling on the 1st of February, Car Insurance Day provides you with a great opportunity to remind your clients about the importance of having adequate and accurate vehicle cover – whether it’s for personal or commercial purposes.

This campaign is a great way to use topical events and calendar dates to promote your services, and highlights the simple mistakes often made by drivers that could ultimately invalidate their car insurance.

Valentine's Day

In the run up to the day itself, promote a limited or exclusive Valentine’s offer or policy discount. Setting time limits creates a greater sense of urgency, leading to higher “purchase intentions”.

For maximum effect, we would recommend targeting your hottest prospects using your recent open and click-through reports to identify those ready to commit.

With a non-promotional angle, this is a great engagement email to reach out to contacts in your database, targeting past clients or those with policies that are due to lapse with a specific offer to win back their business.

Avoid heartbreak

High-value jewellery is one of the most commonly gifted items over Valentine’s Day, yet one that’s often overlooked when it comes to insurance – with seven in ten partners forgetting to organise engagement ring insurance before popping the question.

With online searches for “how to propose” surging 82% over February, and more than one million people likely to get engaged on the 14th, the chances are that many of those engagement rings will go uninsured until the buzz has settled down.

This campaign reminds your clients to show caution with any high-value jewellery that they may give or receive.

Protect the people you love

Now that your customers are back on track after Christmas, many will be planning big changes for 2020. Whether it’s a new job, a new home, or a new addition to the family, make sure they’ve considered what this means for their policies.

In a month all about giving, this campaign is geared around your life insurance policies.

Many UK adults put off obtaining cover, prioritising other purchases that they think are of more immediate importance. This email challenges the excuse of “I can put off life insurance for another year” and considers the benefits of organising it sooner rather than later.

Retain and educate your core clients, cross and upsell your policies, and streamline your renewal chasing.

Learn more about the complete multi-channel marketing platform for insurance professionals – download our guide.

We’re helping The Bateman Group, watch this video to find out how…